Russian NPP Construction Market

Currently, 10 nuclear power plants operate in Russia (total of 33 generating units with design capacity of 24.2 GW) generating about 16% of the total electric energy produced.

Scope and prospects of development of the Russia’s NPP construction market are defined in the Long-Term (2009–2015) Activity Program of State Corporation ROSATOM approved by the Resolution of the Government of the Russian Federation No. 705 of September 20, 2008, and in the General Allocation Scheme of Power Industry Facilities till 2020 approved by the Order of the Government of the Russian Federation No. 215-r of February 22, 2008.

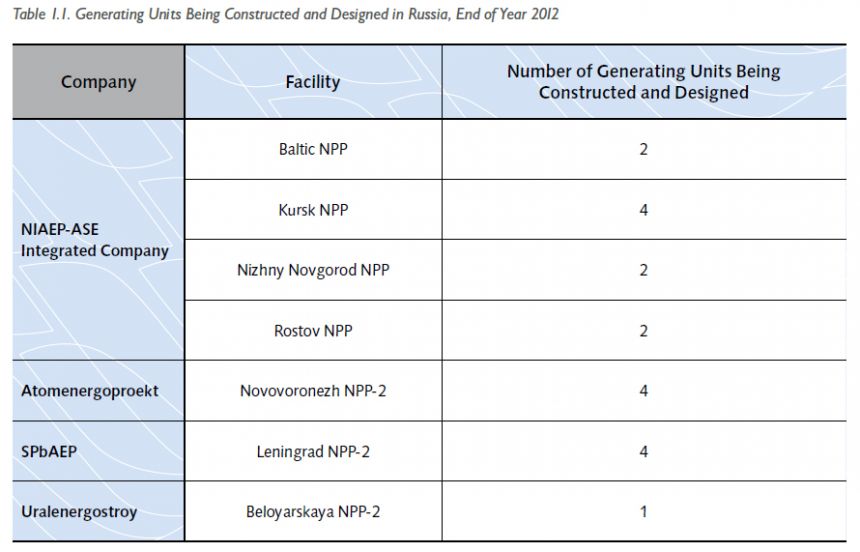

In 2012 four companies acted as general contractors in the market of nuclear-power facilities construction in the Russian Federation:

- NIAEP-ASE Integrated Company;

- Atomenergoproekt;

- SPbAEP;

- Uralenergostroy.

19 NPP generating units are being designed and constructed in the Russian Federation as of the end of year 2012. 10 of them are being constructed by the Integrated Company (see le 1.1).

The share of the Integrated Company in the NPP construction market of Russia amounts to 53% (see Fig. 1.1).

The main customer of the Integrated Company in the Russian market is the Rosenergoatom Concern being the member of State Corporation ROSATOM. State Corporation ROSATOM defines the Russian production distribution market, scope of work and duration of performance thereof.

Information on facilities being constructed and designed is given in Section 3 Performance Results of Strategic Importance.

Table 1.1. Generating Units Being Constructed and Designed in Russia, End of Year 2012

Fig. 1.1. Integrated Company Share in NPP Construction Market of Russia in 2012

International NPP Construction Market

According to the data of the World Nuclear Association (WNA) 6, over 60 generating units are currently at various stages of construction in 13 countries of the world. This estimate is confirmed by the IAEA report of September 9, 2012.

According to the IAEA report, the total NPP generating capacity in the world will increase from 375.3 GW to 501 GW (low scenario) or to 746 GW (high scenario) by 2030. If to assume that the average generating capacity of a reactor equals to 1,000 MW, one may forecast, that 126 generating units will be built under the low scenario and 371 – under the high scenario from 2010 to 2030.

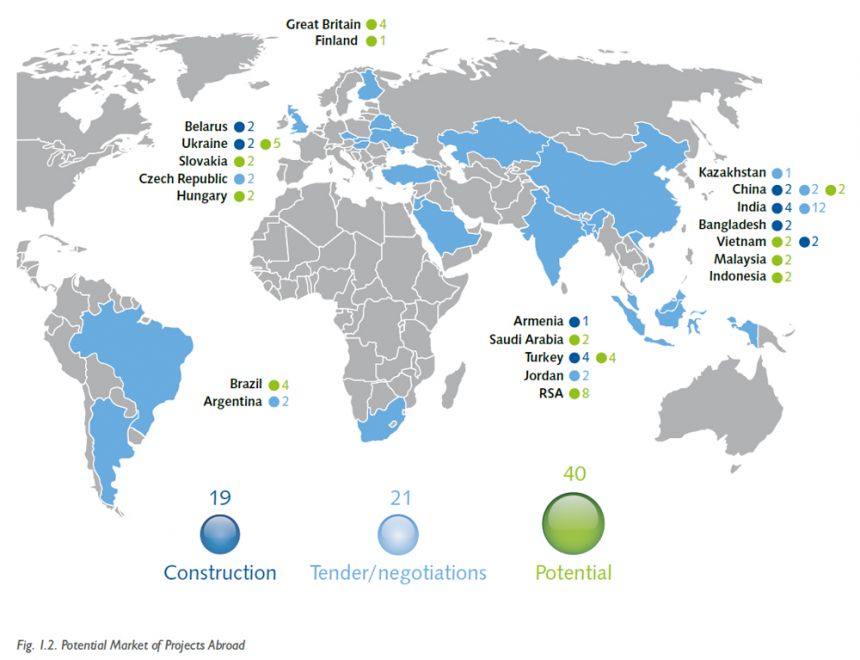

Till 2030 the potential stock of orders of State Corporation ROSATOM in the international markets may amount to 80 generating units (currently, title establishing documents have been signed with regard to 19 generating units, in addition, organizations of State Corporation ROSATOM carry on negotiations and participate in tenders with regard to 21 NPP generating units abroad, 40 generating units afford ground for expansion of Russian companies) (see Fig. 1.2).

The share of the Company in the global NPP design and construction market, including the Russian market, amounted to 33% in 2012, and in the period from 2010 to 2030 this index may reach 30% under the low scenario or 10% under the high scenario.

Information on facilities being constructed or designed abroad is given in Section 3 Performance Results of Strategic Importance.

Fig. 1.2. Potential Market of Projects Abroad

Service Market

Currently, the Integrated Company is rendering services – maintenance and repair, modernization, assets management – for the following nuclear power plants:

- Paks,

- Temelin,

- Bohunice ,

- Tianwan.

An assessment of market opportunities was carried out. Need in competences for rendering services of various types is described in Figure 1.3.

In the services market the Company plans to act as a general contractor of large projects on technical maintenance, repair and modernization, and as a consultant in the field of assets and education management.

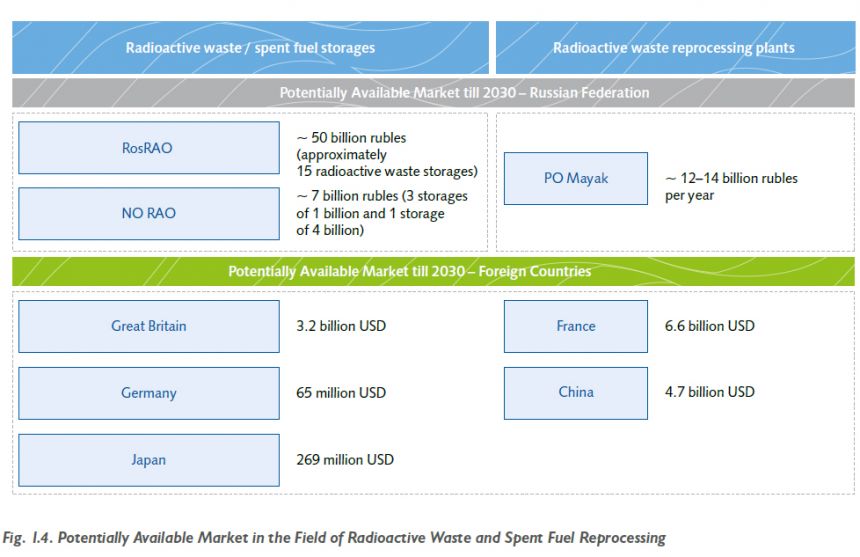

Market of Radioactive Waste and Spent Fuel Reprocessing Facilities Construction

The market of facilities construction in the field of radioactive waste and spent fuel reprocessing is divided into two segments: construction of storages for radioactive waste and spent fuel and radioactive waste reprocessing plants. The total potential volume of foreign markets amounts to 348.5 billion dollars (see Fig. 1.4).

Fig. 1.3. Need in Competences for Rendering Services of Various Types

Fig. 1.4. Potentially Available Market in the Field of Radioactive Waste and Spent Fuel Reprocessing

In order to strengthen its market positions, the Integrated Company plans to increase its competencies as a general contractor and designer of radioactive waste and spent fuel reprocessing plants and to establish its own production base.

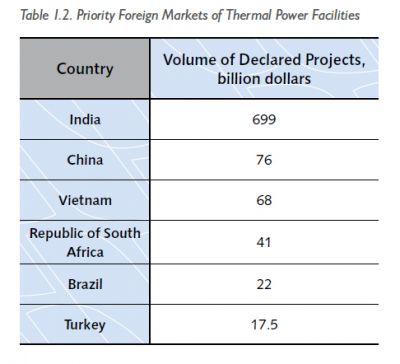

Market of Thermal Power Plants Construction

Currently, the volume of the Russian thermal power market is rather restricted. The existing projects on construction and commissioning of additional facilities till 2020 are contracted within the Capacity Delivery Agreements (CDA) by various contractors. Commissioning of facilities without CDA requires establishment of an investment support mechanism which has not been yet elaborated. According to Booz & Company 7, from 2012 to 2020 it is planned to commission thermal power stations with a total capacity of up to 10 GW. Till 2030 it is planned to commission 25 to 35 GW, in addition modernization of 7 to 10% of the existing TPP facilities will be required. The current share of the Integrated Company in the TPP construction market amounts to 5 to 7%.

In the conditions of a restricted TPP construction market in Russia the Integrated Company sets the following targets:

- Preservation of the current share in the Russian market;

- Implementation of 3 to 4 projects in 1–2 countries abroad (see Table 1.2).

Table 1.2. Priority Foreign Markets of Ther mal Power Facilities

6 See details: http://www.world-nuclear.org/

7 http://www.booz.com